Iceland Venture Studio Investment Thesis

Back to the VC Thesis collection

Tl;dr: The investment thesis of Iceland Venture Studio. They’re a small fund in Iceland.

I found this thesis from a tiny VC fund in Iceland. Their first fund was $5m, and from what I can tell they raised £3m for their second fund (with a target of $35m). The thesis isn’t terrible and is a lot more detailed than some of the pathetic ones I’ve chosen not even to bother including.

Iceland Venture Studio Investment Thesis

Changing Technology Landscape driven by Customer Centricity [1]

Personal data, privacy, sustainability and security are acknowledged mega-trends that are being decentralized[2].

We are on the cusp of the next wave of services, products, applications and solutions where the individual consumer is in total control of all the interactions (s)he has with said product or service.

The core of user interaction is now based on user data shared through the Cloud. The age of centralized data aggregation is waning; Facebook, Amazon, Netflix and Google (the FANG companies) have already won that battle.

Human-machine interaction is changing with the advent of voice-activated device technologies ranging from from Google Assistant to Amazon Echo. The new devices are also incorporating Augmented Reality (AR), granular sensor technology which enables the user to change their interaction with the application’s user experience and interface based on location, sensory data and time-dependent wants and likes.

It is not a stretch to say that conventional software development is undergoing a paradigm shift and fundamental transformation. The growth in Artificial Intelligence (true AI or Machine Learning) requires access to relevant real-time data, which can be dramatically different than the conventional test data that the software engineer used while building the application. This is also the reason why AI software engineering is dramatically different than conventional software engineering. This transformation in our experience is just starting.

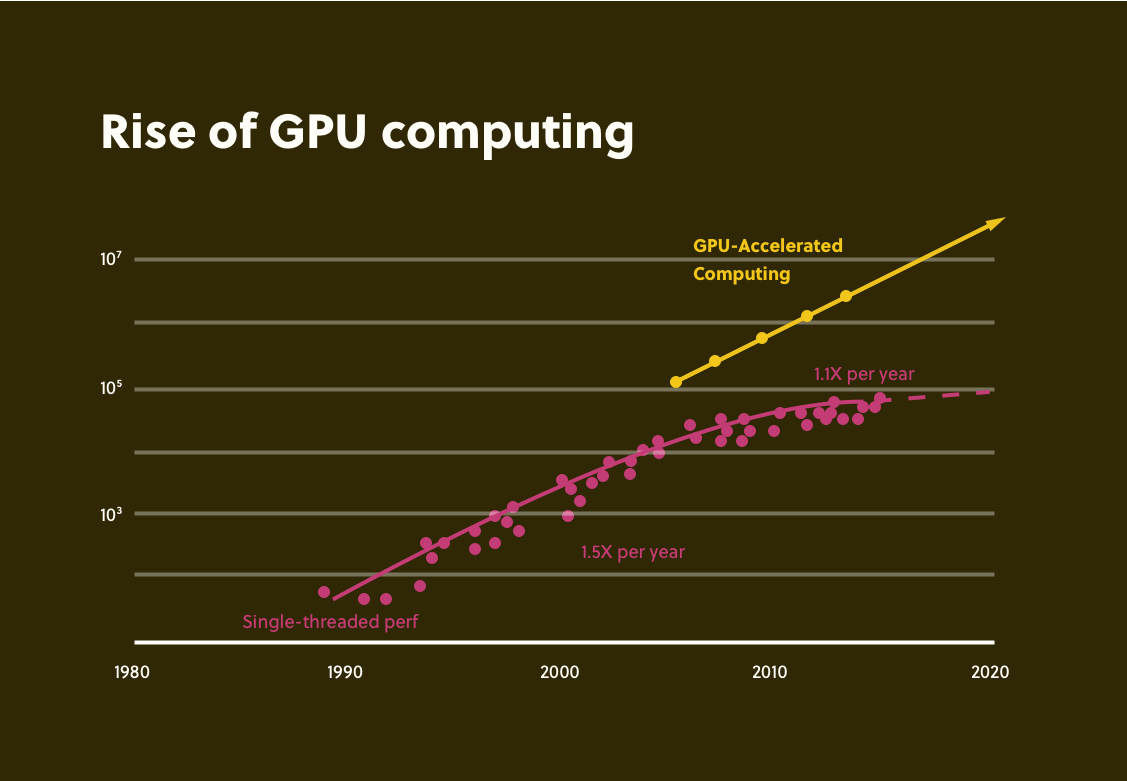

Building learning machines requires completely different hardware architecture, development infrastructure, software engineering discipline and reusable frameworks. The core of that is the data set or the model used to train the algorithms. The data sets cannot be complete by design, but needs to be as close to reality as is possible so the machines or algorithms can quickly adapt and provide value for the end user. The advances in hardware architecture are even challenging Moore’s Law [3] [4].

As the hardware shift is becoming more evident, the software platforms, methods and approach will adapt quite rapidly. We believe it is inevitable – we are not saying that the current disciplines are obsolete, but rather that they require a radical rethink. Innovative founders and entrepreneurs are going to be at the cutting-edge of this transformation.

We believe in investing in founders and companies who understand and are accelerating the adoption of this technology shift to leverage customer centricity. We believe the next generation of founders and companies that are changing the nature of data capture, processing, interactivity and algorithmic development of value with the human-machine interaction will lead us into the age of AI and AR.

The founders, investors and advisors of Iceland Venture Studio (IVS) have a strong track record of working with founders and building valuable companies that were either acquired by a larger company or have become profitable ventures.

We are currently batting 1000, i.e. all our investments have returned more money than what was invested when we became engaged with the company. We have practical knowledge on how to work with founders who have the capacity to build great companies: we think it is more than “founder picking”, it is also mentoring and coaching. We take an active role in mentoring and coaching the founding team in technology design and development, strategy, business development, team development and recruiting as well as operations. We have explicit experience taking founders from the idea stage to a profitable exit. The greatest value that we add is in helping founders navigate multiple priorities, exposing them to a network of influencers, sequencing tasks and accelerating the value proposition development of the company.

Why Iceland

Iceland is a perfect ecosystem to test ideas rapidly, especially for consumer- facing companies. We have successfully scaled companies out of the Icelandic ecosystem to the global market. Given our thesis and belief that the Personal Data Economy is a mega trend, Iceland is a perfect microcosm to test, validate, scale and/or kill ideas that do not get traction in the Icelandic ecosystem. We believe if the value creation is obvious in Iceland, then the company has a very good chance to make it in the global marketplace.

The founder of IVS was the first investor in CLARA, a text analytics company that utilized the above model to test the hypothesis in Iceland and once validated, started expanding the customer base in Silicon Valley. Jive Software (NASDAQ:JIVE) acquired CLARA within the second year of operation outside of Iceland.

The same model has been tested and validated in a number of Icelandic companies the founder were involved in, such as GreenQloud (acquired by NetApp NASDAQ:NETAPP), Guide to Iceland etc. In addition to the above companies, a number of startups from Iceland have successfully validated their ideas in Iceland and expanded globally, most notably Data Market (Acquired by Qlik), Meniga, Modio 3D (Acquired by Autodesk), CCP Games (Acquired by Pearl Abyss), LS Retail etc.

All of those companies were either acquired or are growing profitably in the global marketplace. We believe this model works, the secret that we have discovered is to start the conversation with the founders with the global market in mind but build to test for the local market initially and rapidly. We have experience doing this with a number of founders and more importantly we have built a network of influencers in markets outside of Iceland where we can get the founders started quickly when an idea starts getting traction in Iceland.

In addition to the above examples, we have invested in 26 companies and have had 8 exits; the exits include Buuteeq – Priceline.com (NASDAQ:PCLN) acquired this marketplace for Mom-and-Pop boutique hotels. We have a strong international network of investors, entrepreneurs and startup community leaders who help and accelerate the company-building journey of the teams that we work with. All the other companies in our investment are still in development and a few of them have potential to be very large companies [5].

We believe that we should learn our chops with our own capital before offering this experience and opportunity to other investors, we have been in training with our own capital and we have a repeatable model, which has provided excellent returns. We believe we are now ready to scale our learning through the studio.

The Model

Iceland Venture Studio is a Startup Studio for Personal Data, Privacy, Sustainability and Security. We develop ideas and validate or kill them (ruthlessly). We are able to rapidly validate ideas in Iceland because of our experience of doing this a number of times. We work with the best entrepreneurs from around the world to turn the best ideas into fully-funded companies with rapid customer adoption.

We are active participants and leaders in the Startup Ecosystem in Iceland and globally. We have served as judges in Startup Pitching Competitions. One of the founders of IVS is also the founder of Startup Iceland, a conference focused on entrepreneurship, startups and investing in early stage companies in Iceland. The event was built to bring together the entire startup community in one setting and enable founders to connect with influencers and investors from various other communities.

We have been mentors in all the major startup accelerators in Iceland and were instrumental in getting those established in Iceland. It is not a stretch to say that the best founders in the Nordics reach out to us in various different setting and we get to work with the best.

In addition to the above event, we also have an active community on the Startup Iceland social media platforms and the Startup Iceland blogs. We believe in building demand before we offer the product or service, we are at a point in the Nordic countries where there is a lot of demand for smart capital. We provide that through Studio.

We have brought together a toolbox for Founders through what we call the Developer’s Ecosystem. The Developer’s Ecosystem is a growing multidisciplinary team of developers, designers, marketers, analysts, scientists and operators who are passionate about solving hard problems and building companies. Building a company is hard, especially if you are a first-time founder, inventor or a technologist. We have had the opportunity to work with a number of Founders and Entrepreneurs who have also built a global network of investors, mentors, advisors and operators with the same obsession as ourselves in helping founders step up to the next mega-trend.

Through the Studio, we are adding to our Capital Ecosystem a group of Venture Capital Companies and Angel Investors who believe in our vision and are willing to put ‘skin in the game’. We take active roles in helping founders build companies. We sit on the side of the Founder and help them with our network and knowledge to navigate the process of building and scaling their companies.

The Capital

Foundation Seed Fund

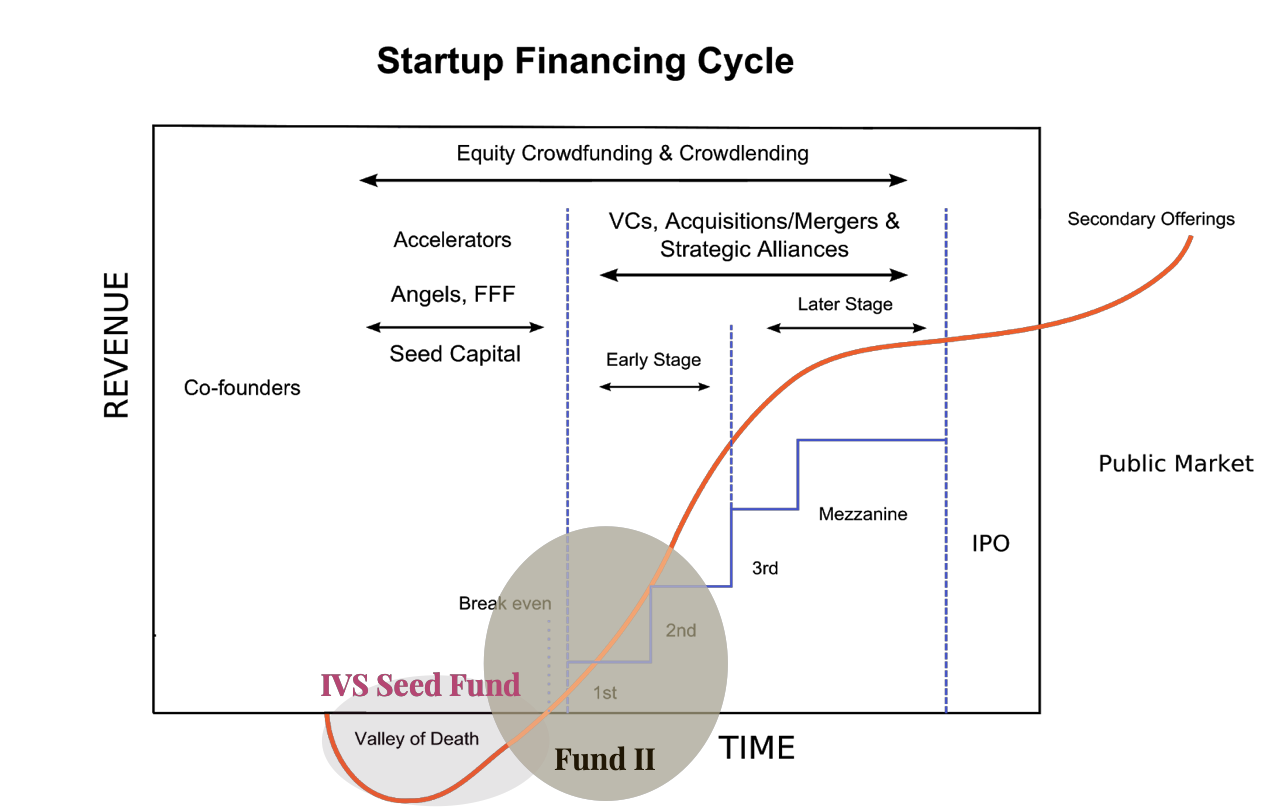

Since we start working with ideas, we typically write small checks that are even pre-seed funding (USD 25,000 to 50.000) followed up with Seed funding (USD 100.000 to 200.000). Our Capital Ecosystem members have the ability to write follow-on checks, as the company-building process requires considerable resources when we see the companies starting to accelerate. That being said, we do believe that founders need to drive this conversation.

We provide assistance in raising capital if the founders want to go down that road. We are capital efficient or even frugal to a point of fault because we think those are good disciplines of responsible leaders. Resources need to be managed effectively and since we form the core advisory role with the founders, we consult, educate, debate and bring capital planning discipline to the founders and companies that we back.

We manage the capital that has been trusted to enable founders working on hard problems. The fund size is USD 5.000.000 and the General Partners does not take a carry on the returns – as we are active participants in the development of the company, we get equity compensation from the founders if the founders so choose.

The seed fund has invested is some of breakthrough technologies and companies that have the potential to impacts billions of consumers. The founders come from Iceland, India, Israel, Croatia and Silicon Valley. We are tackling hard problems like Diabetes, Energy Storage, Reinventing Banking, Mental Health, Empowering the disabled and Enabling the future of work. These teams have accelerated rapidly once we started working with them and we are excited to see them blossom into great companies.

Fund II

We are launching Fund II, where Iceland Venture Studio will act as a General Partner.

The capital base for Fund II is USD 35.000.000. Fund II will invest in founders and startups that are further along in the company development stage[6]. We get a number of founders reaching out to us and wanting to work with us. They are either in Pre-Series-A or Series-A stage. We want to be able to support them and also to defend our holdings on the follow on investments from our Seed fund if they satisfy the due diligence and investment criteria for Fund II.

Investing Philosophy

We understand exponential growth and power-law [7] distributions. We believe in helping founders experience that journey. We are founders in our own right; we think founders have the uncanny ability to see the future when many do not and to see value where no one sees value that is a true strength. Financial returns are easy to measure; so many investors tend to focus on the actual return numbers. We admit that we are sticklers on performance, but our motive and philosophy is not driven by counting the spoils but from helping founders win. We believe if we make founders win, the returns far outstrip any performance goal that we set for ourselves. This understanding comes from investing in founders ourselves.

Investing in the Power-law or exponentially distributed world is hard. Not only is it hard, it restrictive as well, every follow on investment we make should have the capacity to return to us the entire fund [8]. We as GPs need to know how to make the investments work while actively helping the founders build their companies. We apply the Kelly Criterion [9] rule for capital allocation after the pre-seed investment and follow-on investments. The decision making criteria is systematic but the decision to invest in founders and entrepreneurs is always qualitative because the stage at which we choose to invest is always a high uncertainty and low data world.

Seed is really hard. You lose way more than you win. You wait the longest for liquidity. You lose influence as larger investors come into the cap table and start throwing their weight around.

For entrepreneurs just starting out, it will be tougher to raise your first rounds. That is how it always has been so it is a return to normal. It is not great news, but it is the reality. If you price your seed round appropriately and have a good team and plan, you can raise money. But it will be harder. For investors, it means seed rounds are going to be the place to be. When others leave the market, it is time to get in.

– Fred Wilson, avc.com and Managing Director of USV one of the most successful Venture Capital firm in the last decade

We think Fred Wilson is right, it is going to be hard but nothing worthwhile is easy and we like to do hard things and win.

1 – Customer centricity is a strategy that aligns a company’s development and delivery of its products and services with the current and future needs of a select set of customers in order to maximize their long-term financial value to the firm – Customer Centricity: Focus on the Right Customer for Strategic Advantage by Peter Fader. We have noticed that successful startup founders do this naturally and that is a secret

2 – Decentralization or decentralisation (see spelling differences) is the process by which the activities of an organization, particularly those regarding planning and decision making, are distributed or delegated away from a central, authoritative location or group. The internet is example of a decentralised system.

4 – 40 years of Microprocessor trends by Karl Rupp

5 – We don’t believe in mythical creatures like Unicorns, but that is the term used by conventional media. We like companies that can impact a large number of people if the industry wants to call it a Unicorn, who are we to judge.

6 – IVS’s Seed Fund and Fund II are operated differently with different evaluation criterias, some of the Seed Fund portfolio companies may qualify for Fund II but it is not automatic. We believe that we need to be transparent in what we do and we believe in total transparency. No team that we invest in Seed will be considered or picked without the same due diligence applied to teams that are considered for Fund II

7 – In statistics, a power law is a functional relationship between two quantities, where a relative change in one quantity results in a proportional relative change in the other quantity, independent of the initial size of those quantities: one quantity varies as a power of another. For instance, considering the area of a square in terms of the length of its side, if the length is doubled, the area is multiplied by a factor of four. Source Wikipedia

8 – If we invested $25.000 + $100.000 in a company then that investment needs to return $5.000.000 i.e 40X which is only possible if the potential of the company is large and has the capacity to capture large value

9 – In probability theory and intertemporal portfolio choice, the Kelly criterion, Kelly strategy, Kelly formula, or Kelly bet is a formula used to determine the optimal size of a series of bets in order to maximise the logarithm of wealth. In most gambling scenarios, and some investing scenarios under some simplifying assumptions, the Kelly strategy will do better than any essentially different strategy in the long run (that is, over a span of time in which the observed fraction of bets that are successful equals the probability that any given bet will be successful). It was described by J. L. Kelly, Jr, a researcher at Bell Labs, in 1956. The practical use of the formula has been demonstrated. The Kelly Criterion is to bet a predetermined fraction of assets and can be counterintuitive. In one study, each participant was given $25 and asked to bet on a coin that would land heads 60% of the time. Participants had 30 minutes to play, so could place about 300 bets, and the prizes were capped at $250. Behavior was far from optimal. “Remarkably, 28% of the participants went bust, and the average payout was just $91. Only 21% of the participants reached the maximum. 18 of the 61 participants bet everything on one toss, while two-thirds gambled on tails at some stage in the experiment.” Using the Kelly criterion and based on the odds in the experiment, the right approach would be to bet 20% of the pot on each throw (see first example in Statement below). If losing, the size of the bet gets cut; if winning, the stake increases. Source Wikipedia

Comments (0)

There are no comments yet :(